Category Archives: Bookkeeping

Stale Dated Checks

Even if both banks accept the https://x.com/BooksTimeInc old check, it could bounce later due to insufficient funds. If the check writer closes their account or doesn’t have enough money, you’ll be responsible for the check amount and possible fees. In the United States, each state has laws about unclaimed property, which includes checks that have yet to be cashed within a certain time. Businesses must give away unclaimed property after a specific period, including uncashed checks, to contractors, vendors, employees, and stockholders.

Examples of Expiration of Checks by Type

HBL has been providing tax services, accounting services, auditing and attestation services, consulting services, and various other services since 1973. If you have property that falls into any of the above categories, you may need to report it to the State of Arizona. Visit the unclaimed property website and click on the “Holders” tab to report the property for further instruction. There are forms that need to be completed and you will need to remit the funds to the state. The state will then hold those funds while they attempt to find the payee.

Haryana Code on Wages Rules 2021

- Each state has its own requirements, such as a minimum dollar amount or a minimum length of dormancy.

- A practical company policy can be established in an organization as per the state laws.

- Check your account to ensure no checks older than six months are still uncashed; the bank might consider them stale.

- Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

- This is regardless if all the information you have included on the cheque is correct and accurate.

With reasonable attention to detail, it’s possible to use personal checks safely and with minimal risk of bouncing. Dishonoured cheques happen when the cheque doesn’t go through and ultimately can’t get paid. If a cheque is dishonoured, it will get returned back to your bank or financial institution and there are few reasons for this. You might have non-sufficient funds in your bank account or the signature might be incorrect. Or, there’s a what is considered a stale dated check difference in the numerical and written amounts. A bank or financial institution is required to cash certified cheques and cashiers cheques even if they’re more than six months old.

Can I Cash a Check From 2 Years Ago?

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. If the stale check is returned for any reason, then a person’s bank may charge a fee for returning the check to the person. They may then reverse the deposit if the funds were not placed on hold.

Use this information to create a policy on owner contact and state remittance for different categories of uncashed checks. https://www.bookstime.com/ NAUPA’s free reporting software can help you craft a sensible plan. Some banks may allow you to deposit a check that’s gone stale if they believe the funds will be available.

- Uncashed checks to vendors, contractors, employee payroll, and distributions to stockholders are all potential unclaimed property.

- Your bank may ultimately decide to ignore those instructions and process a check anyway.

- If they need the cash early, they should bring back the check and ask the issuer to renew with an early date.

- And, if the cheque doesn’t go through because you have insufficient funds, you might have to pay extra interest or a chargeback fee.

- Our suite of security features can help you protect your info, money and give you peace of mind.

- Be sure to list all information, because the document will only be indexed as directed by you.

Rental Property Accounting Software by Stessa

However, if the tenant refuses to move out and their move-out date has come and gone, it’s time to contact an attorney. If you notice that Sally Mae in Unit A has not moved out the day after she was supposed to, don’t jump to conclusions. Mistakes happen all the time, and it’s possible that Ms. Mae just got her move-out date confused. It’s a good idea to send reminders to tenants who have a move-out date coming up so these good-natured mix-ups don’t occur often. 6 templates to manage your business, personal, and program spend on an annual, quarterly, and monthly basis. Of course, if your solution rolling forecast best practices: a guide for fp&a professionals isn‘t working for your company, you should find a new one as soon as you can.

Among the software’s features are automatic reconciliation, categorization using machine learning technology, and income and expense tracking. In addition to AI in accounting software, cash flows from investing activities definition the importance of AI sales tools cannot be underestimated in the quest for growing your business. Manual tasks such as data entry are automated and data-driven insights help in sales forecasting. When you brag to your next-door neighbor about how well your rental property is doing, the odds are you’re not talking about your accounting software. Considering the many facets of property management, we recommend all-in-one solutions like DoorLoop, which can take care of your bookkeeping, work order management, tenant screening, marketing, and so much more. Which real estate accounting software is suitable for your budget and will provide you with the features and flexibility your business needs?

Rent Manager

It provides automated data connections and single-entry accounting to keep everything simple and easy to understand. The best rental property accounting software helps real estate investors to improve cash flow, strategically reduce operating expenses, and increase ROI year after year. MRI Software partners with over 140 products and service providers to meet the unique needs of every rental property investor. Rental property accounting features from MRI include tenant screening and lease templates, online rent collection, rent and vacancy tracking, and credit risk management. Property Matrix is property management software designed to streamline accounting processes for rental properties.

Hemlane is a comprehensive platform with built-in bookkeeping and leasing tools and property management features. To maximize efficiency with real estate bookkeeping software, you should regularly update financial records, utilize automation features, and monitor key performance indicators. Your accounting software should provide you with the tools necessary to stay on top of this bookkeeping and even automate it. When choosing bookkeeping software for your real estate business, compare different pricing plans to find a solution that fits your budget and offers the necessary features. Financial reporting provides insights into the financial health of rental properties by summarizing a property’s income and expenses. However, QuickBooks Online lacks some specialized features specific to rental property management.

Late Payment Reminders for Rental Property Tenants

By assessing your needs, you can ensure that the chosen software meets your requirements and contributes to the success of your rental business in particular. Now you know because you have accurate numbers to tell you what accounts are paid and how much money you are bringing in. However, Hemlane’s services may be more aligned with hands-on property management rather than optimizing investment performance. Features include enterprise-class accounting, supercharged reporting, and intelligent document management. We invest in deep research to help our audience make better software purchasing decisions. We’ve tested over 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews.

- Use your accounting software’s reporting features to generate reports for rent collection and overdue payments.

- Users can send invoices, monitor expenses, and collect rent payments online.

- With quality property management software, you can avoid nightmare tenants, streamline your operations and effectively protect your rental profits.

- Xero has multiple pricing plans depending on the size and goals of your business.

What Accounting and Bookkeeping Software Should You Use?

Your choice should save you time and reduce errors in your company’s reporting, giving you peace of mind that your bookkeeping is accurate and taken care of. SimplifyEm has multiple pricing tiers based on the number of units you have. DoorLoop also offers multiple pricing tiers based on your needs and will scale with you as your portfolio grows. Most of these top software picks have the essential features outlined above but differ in pricing. The one you choose depends on your needs as a landlord and the size and type of assets in your portfolio. As CFOs, we know how critical and challenging it is to make the right decision when selecting software.

While his real estate business runs on autopilot, he writes articles to help other investors grow and manage their real estate portfolios. REI Hub is specifically designed for rental property owners who want to take the stress out of bookkeeping. AppFolio offers a full suite of accounting features so that you can pick and choose the modules you want to use. The software is good for beginning real estate investors who don’t have an accounting background, and for professional bookkeepers and accountants. Stessa is a cloud-based digital platform created by real estate investors for real estate investors.

For example, the software might send you an email or text with a one-time code so that your account is protected by two shields instead of only your password. The software deals with highly sensitive financial information pertaining to your bank account, rental business, tenants, and more. From accounting software to customer relationship management (CRM) tools, these integrations can greatly enhance the efficiency of landlords and property management companies and help them stay organized. You pride yourself on offering professional property management services to keep tenants comfortable and happy in their examples of straight-line amortization homes.

Best Accounting Software for Small Businesses for October 2024

However, it’s only available in English, so if you’re not a native English speaker, this might not be the right software for you. Bonsai or Hello Bonsai is a desktop accounting software designed for freelancers. It has free and paid versions, with the latter having more features, such how to use depreciation and amortization for your financial reports as invoicing and bookkeeping.

Kashoo is a great choice for small business owners who want straightforward accounting software that is easy to set up. Xero is a great option for large teams and SMBs looking for accounting software that multiple team members can use. Freelancers and entrepreneurs who want an affordable plan might want to look elsewhere simply because of its basic plan’s tax concerns when your nonprofit corporation earns money limitation on the number of invoices.

Zoho Books is the way to go if you’re looking for a comprehensive solution to help you streamline your accounting processes. Is it a one-time fee, or will you need to pay for ongoing updates and support? Accounting software is typically very secure, with features such as password protection and data encryption to protect your information from hackers. Your proposal can be simple or include different packages and price points for your client. Once you’ve submitted your proposal, Bonsai will notify you as soon as your client has viewed it and facilitate clear, concise communication between navigating freelance taxes in 2020 the two of you.

- The fee varies, depending on whether the client or the accountant is billed.

- We like FreshBooks for service-based businesses because it excels at producing proposals, tracking time on projects, and receiving payments—all key processes for service-based businesses.

- Xero is a full-featured accounting software with advanced features such as project tracking, file storage, customizable invoices, a full-featured mobile app and much more.

- We wanted to get their opinion about how simple the software was to use and that, according to recent users, the companies provided satisfactory customer service.

- It was highly customizable, allowing me to answer details about the invoice that would aid in filing it in my storage system and making it searchable.

- We maintain editorial independence and consider content quality and factual accuracy to be non-negotiable.

Small business accounting software can generate them, but you may need an accounting professional to analyze them and tell you in concrete terms what they mean for your company. Most are the type that any small business owner could customize, generate, and understand. Next, you have to ask yourself whether you want access to the transactions you have stored in online financial accounts (checking, credit cards, and so on). Enter your login credentials for that account, and the software imports recent transactions, usually 90 days’ worth, and adds them to an online register.

This is a big help for businesses that want to ensure they’re on the right track. Forecasts are based on past data and trends, so you can trust that they’re worth listening to. Another notable feature is its accounting automation, which lets you automate repetitive tasks such as billing and invoicing. This allows businesses to increase operational efficiency and save time on mundane tasks, so they can focus on strategic tasks instead. It even has a video tutorial on how to set up your merchant account. Now, despite having your whole team onboard, you don’t necessarily have to share all the sensitive information with them.

How to Choose the Best Desktop Accounting Software for Your Business

ZipBooks’ iOS app has disappeared from the App Store, and it’s never had a Google Play app worth mentioning. FreshBooks has a 4.5 rating on Capterra with 4,379 reviews and a 4.5-star rating on G2 with 688 reviews. Users say it is extremely easy to use and has all the basic features needed to manage small business accounting needs. However, they say the platform could use more automations and more in-depth reporting.

It’s Tax-Compliant

Patriot is the best accounting software for businesses that want to keep all their financial data in one place. Starting from basic day-to-today transactions to taxes, you can manage everything with Patriot. Here we take a deep dive into the best desktop accounting software to help you decide which is right for your business. Read on for our detailed reviews and comparison of the market’s leading options and discover how tools like Zoho Books, Oracle NetSuite, and QuickBooks can help your business. All of our top picks require minimal accounting experience, provide affordable, customizable accounting features that integrate with other software and apps, and offer cloud-based backup options. We chose AccountEdge Pro as our best accounting software for experienced accountants because of its robust features, reporting capability, and customization options.

Xero — Outstanding Desktop Accounting Software for e-Commerce Businesses

The industry has responded by making software more available on a cloud basis. While a super-niche industry may not have a software option exclusively developed for them, they can generally turn to specialized vendors. These companies pride themselves on implementing specific software solutions in specific environments. They generally offer customizations or add-ons for a generic product that will make it more in line with what the business expects on a day-to-day basis. After testing Wave, we found invoice customization pretty minimal, with only three templates available. You can maintain up to 15 business profiles individually in one account rather than purchasing a subscription for each company file.

What Is the Best Accounting Software for Small Businesses?

It offers businesses a way to manage their finances, inventory, customers, and operations in one place. FreshBooks is one of the most popular accounting software options for small businesses and freelancers. You can send unlimited invoices and customize them to your brand with your logo, color scheme, and font. Consider what you need the accounting software to accomplish for you and your business, and seek out software that will help you accomplish these tasks with ease. For example, do you need invoicing and billing support, or do you also need tax compliance and robust reporting? Also research customer support, customer reviews, integration capabilities and growth potential.

Users also say that they experience significant bugs with updates that sometimes leave necessary features unusable until the bug is resolved. I simply had to input my email, name and phone number into a simple sign-up form. Once I finalized the invoice, I could click the “send to” button at the top of the invoice and input an email address, a subject and a message to send the invoice. Or, I could click “share via link” to generate an invoice link sendable via text, social media or some other communication channel. Signing up for the free trial required I simply provide my name and email, then retrieve a code from my email address to verify my identity. From there, I was asked a few questions about my business, such as the types of services I offer and how big my team is.

Accounts receivable aging report: Guide

Most accounting software also allows you the ability to create a detailed A/R report as well, which shows each individual item or invoice due based on vendor. Negotiating extended payment terms with vendors can alleviate immediate financial strain, while also fostering positive relationships. Addressing any underlying issues, such as invoicing discrepancies or disputes, is crucial for timely resolution and maintaining strong partnerships. This customization in QuickBooks provides the flexibility to filter data based on vendor names, payment status, due dates, and aging periods, offering a comprehensive view of outstanding payables. Click ‘Run Report’ to generate the accounts payable aging report tailored to your specific preferences. Users can initiate the report generation process by running the report, enabling efficient monitoring of unpaid invoices and gaining valuable insights from customer transaction history.

How To Run an Accounts Receivable Aging Report in QuickBooks Online

By accessing customer aging details, businesses can identify overdue payments and take appropriate actions to ensure timely receipt of funds. Once your accounts receivable aging report is ready, you’ll be able to spot which customers are late, how late they are, and how much they owe. You can then take action to get your outstanding payments addressed, such as sending a follow-up invoice or reaching out to a collection agency. An accounts receivable aging report, also known as an aging schedule, will include unpaid invoices from your accounts certified bookkeeper certifications and licenses cpb and cb receivable (A/R). You group your customer invoices into date ranges rather than listing specific dates for when an invoice is due.

Why Is It Important to Run an Accounts Payable Aging Report?

This strategic approach not only ensures timely collection but also contributes to maintaining a healthy cash flow for the business. It allows businesses to track the aging of their receivables and gain insights into the performance of their accounts receivable. Aging reports give you an overview of your when should a company use last in first out lifo customers’ outstanding balances, who are falling behind their payments, how much is still due, and how long they’re past due. The information in the A/R aging report can provide you with meaningful insights that can help you prioritize and improve your collection efforts for overdue accounts. However, if you bill your customers or offer any sort of credit or net terms, accounts receivable is an important metric that you need to stay on top of at all times, otherwise your business’ cash flow can suffer. An A/R aging report will typically list customers on one side (either alphabetically or by size of debt, depending on how it’s filtered) with invoice amounts in 30-day columns going across to 90 days plus.

- Subsequent analysis of the aging categories provides valuable insights into payment patterns and potential issues.

- One of the main uses of an accounts receivable aging report is to identify customers behind on payments.

- Comprehensive customer account information aids in identifying high-risk accounts, evaluating creditworthiness, and segmenting customers for tailored collection strategies.

- Most accounting software also allows you the ability to create a detailed A/R report as well, which shows each individual item or invoice due based on vendor.

- This customization allows you to filter the aging report based on customer and location.

How to Prepare an Accounts Receivable Aging Report

Analyzing aging dates helps in identifying overdue payments, understanding patterns of payment delays, and prioritizing collections activities. Scrutiny of invoice due dates allows for predicting cash flow and assessing the effectiveness of credit terms. above-the-line costs definition Comprehensive customer account information aids in identifying high-risk accounts, evaluating creditworthiness, and segmenting customers for tailored collection strategies. The combination of these elements plays a crucial role in gauging the financial health of a company and outlining strategies for improving cash flow and minimizing bad debts. Putting together regular accounts receivable aging reports, which you can easily do with invoicing software, allows you to identify regular late-paying customers. You can then avoid sending goods and services to customers before late payments become an issue and hamper cash flow.

Aging periods within the accounts payable aging report categorize outstanding payables based on their duration, providing insights into the timeframe of the company’s financial liabilities and payment schedules. Whether you are new to this process or seeking to refine your existing practices, this comprehensive guide will equip you with the knowledge and tools to effectively manage your accounts payable. Let’s begin our exploration of how to run an accounts payable aging report in QuickBooks.

Fees also stay the same as your business grows, making it a much more affordable option when compared to Quickbooks. However, also unlike Freshbooks and Xero, fees for using the Quickbooks software grow as your business grows and can become quite steep. Quickbooks is the most popular of all accounting software, offering everything your business will ever need for accounting purposes.

To run an AR Aging Report in QuickBooks Desktop, users can follow a step-by-step process to generate a comprehensive report that aids in managing accounts receivable and tracking customer balances effectively. An AR Aging Report, also known as Accounts Receivable Aging Report, is a vital tool for financial management that provides a comprehensive overview of aging periods for outstanding invoices and customer balances. Learn how to create and customize accounts receivable aging reports in QuickBooks Online. Accessing the reports menu in QuickBooks is the initial step in generating an accounts payable aging report, providing access to essential financial insights. It plays a vital role in monitoring the payment status of a company’s entire accounts payable balance.

Based on this analysis, appropriate actions can be taken to address overdue payments and prevent any further delays or discrepancies. An accounts payable aging report is a crucial financial document that provides a detailed breakdown of outstanding payables to suppliers and vendors over a specified period. QuickBooks Online is highly regarded for its excellent reporting feature—one reason why it’s our overall best small business accounting software. It allows you to customize A/R aging reports by adjusting report settings, such as the date range and customer filters.

To set the number of days in each aging period, enter the number of days into the “Days per aging period” field. Enter the number of aging periods to show within the report into the “Number of periods” field. To specify the minimum days past due to show in aging detail reports, type a number into the “Min. To put it simply, the report tells you how much your money your company is owed, therefore the report that has several important uses in business loan underwriting. What you have due to you can also be added to your balance sheet to show larger equity. These reports play a crucial role in identifying any discrepancies or errors in invoicing or billing, contributing to improved financial accuracy and transparency within the organization.

How to Prepare a Bank Reconciliation: 8 Steps with Pictures

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has intuit employment verification an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Step 2: Review the deposits and withdrawals

By leveraging the power of artificial intelligence, you can automate your processes and achieve 95% journal posting automation. If an error is identified during the reconciliation process, it’s not always at the company’s end. Banks can also make errors, and if the mistake can’t be identified, contact the bank. pharmacy accounting Keeping track of the entire reconciliation process is crucial for reporting errors and corrections to the management team later.

Bank Reconciliation Statement FAQs

- In the same month, the company wrote a $5,000 check and deposited $2,000 at the end of the day on March 31.

- The Substantiation software automates the reconciliation of general ledger and supporting balances.

- At times, your business may either omit or record incorrect transactions for checks issued, checks deposited, or the wrong total, etc.

- The statements give companies clear pictures of their cash flows, which can help with organizational planning and making critical business decisions.

- It’s true that most accounting software applications offer bank connectivity, which can speed up the reconciliation process immensely.

If your beginning balance in your accounting software isn’t correct, the bank account won’t reconcile. This can happen if you’re reconciling an account for the first time or if it wasn’t properly reconciled last month. Since you’ve already adjusted the balances to account for common discrepancies, the numbers should be the same. Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet.

How Often Should You Reconcile Bank Statements?

Therefore, if the bank reconciliation is off by a very small amount, the company should try to confirm that the large amounts, especially those caused due to timing differences, are taken correctly. Once these figures are verified, the company can safely assume the error is somewhere in the bank charges or small amounts. Therefore, it can expense out the difference without any consideration to what may have caused it.

When all these adjustments have been made to the books of accounts, the balance as per the cash book must match that of the passbook. If both the balances are equal, it means the bank reconciliation statement has been prepared correctly. Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook. So it makes sense to record these items in the cash book first in order to determine the adjusted balance of the cash book. Once the adjusted balance of the cash book is worked out, then the bank reconciliation statement can be prepared.

The purpose of preparing a bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook. The balance recorded in the passbook or the bank statement must match the balance reflected in the customer’s cash book. It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank. Bank reconciliation statements safeguard against fraud in recording banking transactions. If you’re interested in automating the bank reconciliation process, be sure to check out some accounting software options.

What is the purpose of a bank reconciliation statement?

However, there are situations where a bank reconciliation might be necessary at the earliest. For example, if a business identifies any suspicious activity or unidentifiable transactions, it’s essential to prepare a bank reconciliation immediately. Similarly, if customer payment checks on the balance sheet do not match bank records, a cross-check is necessary. In short, how often a company should prepare bank reconciliations depends on the level of activity in its bank accounts. For companies with a high number of bank transactions, preparing it every month or, if possible, several times in a month is better.

The what is supply chain finance scf guide reconciliation process allows a business to understand its cash flow and manage its accounts payable and receivable. You’ll need to account for these fees in your G/L in order to complete the reconciliation process. The Transaction Matching software utilizes AI to discover and configure matching rules, enabling automatic line-level transaction matching between different data sources.

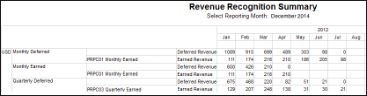

Deferred Revenue vs Accrued Expense: What’s the Difference?

(They can also provide non-GAAP financial metrics for investors if they choose.) If the Securities and Exchange Commission determines a company misrepresents its financials, it faces stiff penalties. The balance sheet shows a company’s assets, liabilities, and shareholder equity. As another example, let’s say you currently work http://driwers.net/what-should-you-do-with-old-hearing-aids-.php as an attorney, providing basic legal services to clients for $1,250 per month. One of your clients decides to prepay for the next six months and sends you a check in the amount of $7,500. Solutions such as Stripe offer traceability that links recognized and deferred revenue directly to specific invoices and customer agreements.

Can You Have Deferred Revenue in Cash Basis Accounting?

It can be classified as a long-term liability if performance is not expected within the next 12 months. Deferred revenue is a payment from a customer for goods or services that have not yet been provided by the seller. The seller records this payment as a liability, because it has not yet been earned. Once the goods or services related to the customer payment are delivered to the customer, the seller can eliminate the liability and instead record revenue.

How Revenue Recognition Works: A 5-Step Guide

A high amount of deferred revenue might indicate strong customer commitment and loyalty, but it might also suggest a lot of deliverables are pending. Deferred revenue is an accounting concept that provides a snapshot of a business’s financial health and operational agility. In subscription-based or prepayment business models, deferred revenue is an especially informative metric for stakeholders ranging from CFOs to investors. Deferred revenue is typically reported as a current liability on a company’s balance sheet because prepayment terms are typically for 12 months or less.

What Is Deferred Revenue? Definition, Journal Entry & Example

- On the other hand, revenue is money that the company has earned through its products or services.

- The company recognizes the revenue on the income statement as earned revenue, even though it hasn’t yet received the payment.

- Deferred revenue (also called unearned revenue or income) is a liability owed to a customer for the value of goods or services the customer has paid for but not yet received.

- Let’s say a software company sells a license to use its software products to a customer for $1,000.

- We temporarily park this amount here since the seller or service provider has yet to fulfill the obligation.

Deferred costs are funds used for commitments that have not yet been met, whereas deferred revenues are funds collected for goods or services that will be delivered to consumers later. Understanding liabilities is crucial for comprehending deferred revenue accounting. Liabilities are caused by various commercial circumstances, all of which are connected to instances in which a firm owes money to another entity. Companies may also misclassify deferred revenue as earned revenue or vice versa.

Understanding how unearned revenue impacts different industries helps businesses maintain financial accuracy and make informed decisions. Since a business does not immediately reap the benefits of its purchase, both prepaid expenses and deferred expenses are recorded as assets on the balance sheet for the company until the expense is realized. Both prepaid and deferred expenses are advance payments, but there are some clear differences between the two common accounting terms. Customer payments for products or services they anticipate receiving in the future are known as deferred revenues.

Tax Tips for Small Business: Prepare Your Business for Tax Season

Whereas recognized revenue refers to the point at which a booking or deferred revenue becomes actual revenue for your business after delivering on the agreement as promised. This comprehensive guide will provide you with a clear understanding of deferred revenue, its impact on your financial statements, and how to manage it effectively. Whether you’re a small business owner or an experienced CEO, this guide will http://www.highspec.ru/techcard_about.htm help you navigate the complexities of deferred revenue and make informed decisions for the future of your business. Deferred revenue can be recorded on the cash flow statement, noted as deferred revenue. Of course, you will want to be sure that you can fulfill your obligations to your customer. As long as it continues operating as it has been, that deferred revenue will eventually appear on the income statement.

When a business receives payment for a service it has not yet provided, it generates deferred revenue. This typically occurs for service providers that hold off on doing https://pro-java.ru/rabota-s-setyu-java/partnerskaya-programma-parimatch-dlya-uspeshnogo-sotrudnichestva/ the project until at least a portion of it has been paid for. Deferred revenue is earned when a business performs its end of a contract after payment has been received.

As a result, the completed-contract method results in lower revenues and higher deferred revenue than the percentage-of-completion method. The category applies to many purchases that a company makes in advance, such as insurance, rent, or taxes. The timing of customers’ payments tends to be unpredictable and volatile, so it’s prudent to ignore the timing of cash payments and only recognize revenue when you earn it. As per basic accounting principles, a business should not recognize income until it has earned it, and it should not recognize expenses until it has spent them. If a company has a large amount of deferred revenue on its balance sheet, it can indicate that there are future sales that have already been secured. This can be a positive sign for investors as it suggests that the company has a steady stream of revenue coming in.

18 Best Accounting Software For Advertising Agencies Reviewed In 2024

To determine the success of ad agency accounting, calculating Return on Investment (ROI) is crucial. Keep track of available staff hours, hours already worked and billable hours organized by each staff member and role at your agency with a staff utilization report. This report lays out the details of staff hours within a given date range, billable or otherwise.

Reliable Time Tracking

MYOB provides scalable business solutions for small to medium-sized businesses, accountants, and bookkeepers, offering advanced features that grow with your business needs. It excels in scalability and adaptability, making it ideal for businesses looking for solutions that expand as they grow. Switch from multiple tools and spreadsheets to an all-in-one software solution for accounting and comprehensive agency management. It was unexpected that we managed to find a tool that allowed us to not only manage projects and tasks better but also allocate our resources and get an overview of our profitability. Productive allowed us to bring it all under one umbrella, which means we got a better picture of our business as a whole. So, whether you’re eyeing expansion or just want to streamline your processes, these insights are your ticket to success.

The accrual method matches income and expenses with the period in which they were earned or accrued, providing predictability and comparability around financial metrics. Billable hours are time an employee spends working on a client’s project whats the difference between purchase order and purchase invoice that will be billed to the client. Not all agencies will use billable hours, but it’s important for any agency to understand how labor costs are allocated to client projects in order to monitor project-profitability.

- By overcoming these obstacles, ad agencies can sustain their financial health and ensure long-term success in a competitive industry.

- Spreadsheets are free and simple, but not very reliable since they require manual data entry and lack system controls that force your accounts to balance.

- Xero is a popular cloud-based accounting software that caters to businesses of all sizes, including advertising agencies.

- Tracking your agency’s WIP balances can prevent cash flow and capacity issues, since WIP represents labor costs incurred but not yet recouped.

- Account reconciliations, perhaps the most important bookkeeping step, involve verifying account balances in your accounting software to source documentation pulled from your bank.

best practices for marketing and advertising agency financial reporting

We’ll discuss your current setup differences between accrued and deferred expenses and identify next steps in building a system that works for your agency, no matter where it is in its development. The agency’s cost to acquire a new client, whether through advertising or another channel. A downward trend indicates that the agency is spending less to acquire clients. Positive numbers indicate that the agency is expanding its client base or capturing additional income from existing clients. If you’re not reviewing the agency’s statements on a regular basis, then you’re not making adequate use of the accounting system you’ve worked hard to build.

How can accounting software help manage project-based accounting for advertising agencies?

As the name suggests, this report provides insights as to how profitable your advertising agency truly is. A profit analysis report offers a comparison of estimated costs and actual costs, along with billable amounts and actual invoices. The report can be as specific as you want it to be with the addition of filters to show the names of clients, a range of dates spent working on projects and more. Using forecasting tools helps anticipate future cash flows based on historical data. It enables better financial planning by ensuring that funds are available when needed to cover operational costs or invest in growth opportunities. Cash flow analysis is crucial for understanding a marketing agency’s financial health.

These KPIs help in identifying areas of strength and weakness within an agency’s operations. Accounting can be complex, especially what is cost of goods manufactured cogm as your business grows and you have more staff members and clients to keep track of. When in doubt, you can’t go wrong by outsourcing accounting and financial management to an experienced firm. An efficiency report is essential when it comes to understanding the efficiency of your marketing company’s active staff members. This report includes the number of jobs worked on by each staff member, along with a breakdown of their billable and non-billable hours worked in a given time. You can also weigh the value of the payroll cost of an individual against their billable hours.

Features include payroll management, easy integration with QuickBooks Online, and detailed payroll reports. Patriot also offers tools for managing employee information, tax settings, and direct deposit options. When considering ad agency accounting, it’s essential to weigh the options between managing finances in-house, hiring freelance accountants, or opting for third-party accounting services. The benefits of using such software include automated invoicing, real-time expense tracking, and seamless integration with other business tools. Ensuring timely vendor payments not only maintains good relationships but also avoids late fees or disruptions in services.

This ties into your time tracking because you’ll need to have historical records of how much time it took to complete similar projects in the past.Most of all, it requires honesty and transparency. But if you must do so, try to get something out of it.Consider charging rush fees or scaling back your service offerings accordingly. You can also consider requesting services from the client, such as marketing opportunities (referrals or success stories), for expedited or cheaper delivery. Enhancing accuracy and efficiency with tech solutions in ad agency accounting involves utilizing cloud-based platforms that allow real-time collaboration among team members. These tools improve data security by storing information securely online while providing instant access from anywhere at any time.

The Very Emerging Role Of AI In The Accounting Industry

AI’s ability to perform this type of work means that 59% of accounting and bookkeeping professionals believe bookkeeping will be the most disrupted direct mail fundraising best practices function by AI. Working with raw data in spreadsheets can be one of the biggest time sinks for CPAs. AI will transform the business we have today and it’s important to be ready for the transformation.

KPMG has market-leading alliances with many of the world’s leading software and services vendors. And there’s no better way to begin than with the ultimate collaborative practice management platform. Vic.ai is a process-oriented AI automation platform designed to help accountants streamline various workflows from invoice processing to payments. Artificial intelligence tools by themselves (think ChatGPT, Google Bard, and others) are most useful when they what is a voucher entry in accounting are integrated into the tools you already work with.

The Dawn Of A New Era: AI’s Revolutionary Role In Accounting

In addition to its efficiency benefits, AI accounting software also helps improve accuracy in financial reporting since it reduces the chance of human errors occurring in calculations or data entry. It also improves insight into customer spending habits through its predictive analytics capacity, which is useful for small business owners who need to know where their budget is being spent most effectively. That shift from roadmap to reality has major implications for finance teams and their auditors—and it brings plenty of opportunities as well. As AI increasingly becomes a core capability for many companies, finance leaders are actively planning to expand its utilization in areas like data automation and generative AI (GenAI), backed by significant new funding allocations.

- AI will transform the business we have today and it’s important to be ready for the transformation.

- This democratization empowers more businesses to make data-driven decisions, promoting a more dynamic and inclusive business ecosystem.

- Finally, even the software vendors themselves are telling the world that their AI offerings aren’t really there yet.

- Our experts at IBM Consulting are taking a comprehensive look at generative AI for F&A and considering the need to balance risks (link resides outside ibm.com).

reasons why your team needs a workstream collaboration tool

Concerns about data privacy, security, and ethical use of AI are critical issues. Accounting firms try to address these concerns by implementing robust data governance frameworks and emphasizing ethical AI practices. This commitment to responsible AI use is vital for maintaining trust and integrity in the profession.

Part I: Opportunities for finance and controllership in the new Generative AI frontier

Whether you’re a CFO, an accountant, a financial analyst or a business partner, artificial intelligence (AI) can help improve your finance strategy, uplift productivity and accelerate business outcomes. Though it may feel futuristic, advancements such as generative AI and conversational AI technology can benefit Finance & Accounting (F&A) now. Moreover, AI usage in accounting also signifies a cultural shift within the industry. There is a growing recognition that using emerging technology is essential for staying relevant and competitive. This openness to innovation is fostering a culture of continuous learning and adaptation, essential qualities in an ever-changing business landscape. Member firms of the KPMG network of independent firms are affiliated with KPMG International.

With AI-powered tools, smaller businesses can now access the kind of analytics and advice that was once the exclusive domain of large corporations. This democratization empowers more businesses to make data-driven decisions, promoting a more dynamic and inclusive business ecosystem. Recent developments in artificial intelligence (AI), including the emergence of Generative AI, are leading businesses to evaluate AI’s potential impact to their business technology strategy. © 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. The level of AI implementation and sophistication is rapidly advancing as well. Leading companies have moved AI finance initiatives from proof-of-concept pilots to full-scale rollouts, tapping into new operating capabilities and competitive advantages while maintaining strong governance.

Explore more insights and opportunities:

This type of software often works with natural language processing (NLP) and machine learning algorithms to provide insights that automate certain mundane tasks for accountants. AI accounting software can help businesses reduce administrative costs, increase accuracy, and save time by automating the bookkeeping process. Take, for instance, the journey of Ernst & Young (EY), one of the largest accounting firms globally. EY has integrated AI into its audit services, employing an AI tool that can review and analyze contracts and documents at a speed and accuracy level unattainable by humans. This tool has dramatically improved the efficiency and effectiveness of audits while reducing the risk of human error and ensuring a higher standard of compliance.

Karbon AI is an award-winning artificial intelligence feature within Karbon’s practice management software. It combines the revolutionary power of generative artificial outstanding check list intelligence and GPT technology with the context of your accounting firm—specifically within email and task management. This is why AI-powered predictive analytics is enabling accountants and finance professionals to move from the time-consuming (and often monotonous) role of generating the reports themselves and into the role of evaluator. AI-driven algorithms can analyze vast datasets, identify patterns, and catch potential risks that humans might overlook. Forward-thinking financial leaders are shifting the tides by using AI to analyze enormous quantities of financial data at speed and scale, providing real-time insights into a business’ financial health.

For AI in financial reporting to be truly impactful and sustainable, independent auditors will need to continue to enhance their own AI understanding and capabilities as well. Indeed, 83 percent of the finance leaders in our survey believe it is important for auditors to use AI in their own processes—a big increase from the 63 percent who cited this in last year’s survey. GenAI can be a powerful tool for professionals to more efficiently prepare effective analysis or documentation and enhance their judgments in a variety of areas, including financial planning and research. However, while GenAI can jump-start accounting and financial reporting processes, it still requires a driver at the wheel. Since GenAI can be inaccurate and miss nuance, experienced professionals must oversee and evaluate outcomes. Professionals may also require training to formulate effective GenAI prompts and guide it to perform a task.

One big example is how companies can best navigate the many barriers to AI implementation and adoption. Because AI and GenAI don’t fit neatly into long-standing technology use and governance policies, barriers like security, legal, and privacy challenges can slow progress for many companies. The AI leaders in our survey plan to increase AI budgets by 25 percent next year and 28 percent over three years. And all other companies in our survey—regardless of their AI maturity level—plan at least 10 percent-plus funding increases for AI next year and at least 20 percent-plus over three years. Automate tasks and work faster with AI and GPT securely integrated into your collaborative practice management.

We focus on your numbers so you can focus on your mission

It shows the various cash inflows and outflows over a specific period, revealing how a nonprofit manages its cash to meet operational needs. It provides insights into liquidity and helps nonprofits plan for short-term cash requirements, ensuring they can cover expenses and sustain programs. Even tiny nonprofits have BIG bookkeeping challenges, like cash flow forecasting, grant tracking, and finding the time to reconcile your accounts.

- They have always provided us with a comprehensive and top-rated service, allowing us to meet deadlines internally and externally.

- We’ll partner with you to automate key accounting processes and create forward-looking plans that make your future feel less uncertain.

- Although seemingly similar, for-profit and nonprofit accounting processes differ in many ways.

- To monitor organizational finances on top of that can feel overwhelming.

- This means your Chazin & Company team is accessible each and every workday – not just certain times of the month.

Get your quote for nonprofit bookkeeping services

We collaborate with you to provide a customized solution that is not only https://www.bookstime.com/ cost-effective but also strengthens your accounting function. Yes, with over 19 years working exclusively with nonprofits, we pride ourselves in having a unique understanding of your accounting and reporting needs. Our accountants are CNAP certified and are updated and trained regularly on nonprofit best practices and the changes to GAAP and FASB requirements that impact nonprofits. Ensuring financial integrity is a vital aspect of running a successful organization. Establish proper financial oversight with the expert help of a team that understands the complex GAAP and FASB reporting requirements for nonprofits.

NJ Chemical Manufacturer Trusts Velan’s Accounting Services

- Properly tracking and reporting accounting transactions ensures financial transparency and helps earn the trust of stakeholders.

- We demonstrate our dedication to data security through the implementation of ISO in our office.

- This combination results in expert advisory services and accurate and reliable financial data.

- We are extremely pleased with the exceptional hospital billing services provided by Invensis.

- As mentioned, nonprofits have to follow strict rules to justify their financial position and fundraising expenses.

- This type of accounting tracks and manages the funds received through grants, ensuring that the money is used according to the terms outlined by the granting organization.

Following that, they will ensure that all transactions are recorded, bank accounts are reconciled, reports are produced, and other audit preparation duties are finished. While a budget may not always be employed in for-profit enterprises, it is seen to be a crucial part of nonprofit accounting. This is because nonprofit organizations often have fairly limited cash sources, necessitating constant strict supervision over their spending.

Our Bookkeepers Certifications

That way, you can be sure that your nonprofit maintains both its 501(c)(3) status and the trust of its supporters. Included free with your engagement, our team of Intacct and Quickbooks Online experts will migrate, setup, and review your chart of accounts to ensure it aligns with GAAP and nonprofit standards. We ensure nonprofits have the tools they need to partner with our team for effective financial record keeping and strategic planning. Have your books done in Aplos, accounting software designed for nonprofits. Our Bookkeeping Specialists can help you budget by fund, accept online donations, and more. Do you understand how your financial activities are impacting your organization?

Since 2000, Invensis has been catering to the diverse outsourcing needs of clients for multiple industries and constantly striving to add value to clients’ businesses. You’ll have a full team of qualified professionals working with you when you work with our nonprofit bookkeepers and accountants, answering queries and offering suggestions to help you succeed. Nonprofits should compare actuals to budget forecasts regularly to assess how things are moving in terms of projected donations, other sources of financing, and expenses. Using historical data for the budget and then accounting services for nonprofit organizations updating it with actuals gives the board a picture of where the organization is at any given time about the original estimates.

Nonprofit vs. For-Profit Accounting

- This is different from the statement of activities, which shows the organization’s financial performance over a period, offering a more detailed view of revenues, expenses, and changes in these assets.

- When you work with us, you’re hiring a trusted partner to help you build and push your mission forward.

- Your dedicated bookkeeping team communicates consistently based on your schedule is available and responsive to you and your business needs.

- Regardless of size, all nonprofit organizations should have access to expert high-level financial advice.

- Donors suspect the misuse of cash and resources if they see any manipulation with the documents.

- To fulfill your mission and impact the communities you serve, you have to raise and allocate funds wisely—That’s why bookkeeping for nonprofits is an essential part of what you do.

The following ideas used in nonprofit accounting are different from those used in for-profit entities’ accounting. Helping small to midsize nonprofits navigate staffing gaps, employee fatigue, and budget constraints – because those you serve can’t afford to wait. “Solid experience CARES Act in leading financial budgeting and financial planning process with superb communication skills.”